Our nlmtd experts and I will be as objective as possible, and although I’m an engineer with two decades of professional focus on energy, this series has no prejudice for any technology versus another. The series is written with the intent to visualize and simplify the probable energy transition roadmap, focusing on (H2) Hydrogen fulfilling part of our energy requirements.

In this first article I will give a general overview and highlight why Hydrogen will be important. In sequential articles we will discuss current and future demand, and zoom in on technology and innovation for production, distribution and storage of Hydrogen.

Hydrogen, the most abundant molecule in our galaxy, does not exist on earth as a stand-alone energy source, but is an excellent energy vector. This excellence comes from the fact that the emission is water when used in a fuelcell, and therefore leaves no environmental footprint. As a molecule, its value-chain has many similarities to the dominating and efficient Hydrocarbon value-chain and processes, and lastly it has been produced and used for decennia, and all regulations, technologies and safety procedures exists.

These are the compelling reasons that make most energy institutions and experts conclude that Hydrogen will enable the energytransition by storing and using renewable energy when and where we need it. The overall conclusion is therefore not if, but how much of, the total energy consumption in 2050 will be through Hydrogen. Whether this will be 10 or 20%, both numbers signify enormous growth that forces us to take action now.

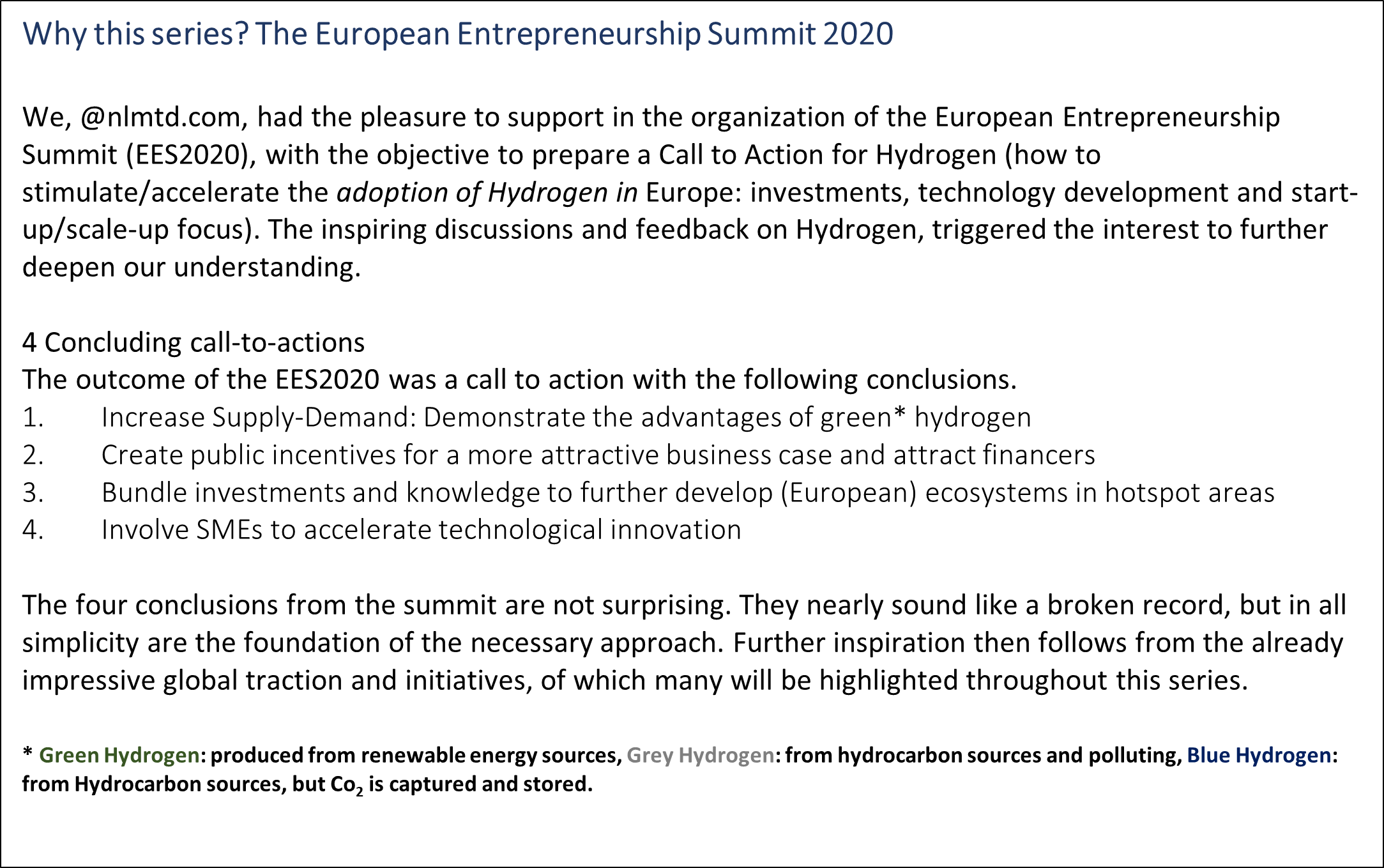

To get Hydrogen to 20% of all global energy supply by 2050, which will be in excess of 125 ExaJoules (see BP graph), we will need 20.000 electrolysers (the size of 100MW, which is the largest plant to be constructed today) to come online every day, starting today until 2050. Naturally, this sounds, feels, and seems impossible, but innovation curves in the past have shown logarithmic improvements. It needs focus, collaboration, competition and a transparent investment climate for this to expect to happen in the field of innovation for Hydrogen also (see box below: Why this series? EES2020 call to Action).

Is H2 guaranteed a seat at the table?

There are 3 major compelling events that guarantee that there is a future role of Hydrogen, and why it cannot be dismissed;

- The molecule is present in abundance. It does not exist as energy source but can be used as energy vector, and the result of retrieving energy from H2 is water. Use of H2 in a fuel-cell therefore has no final negative impact on our environmental footprint.

- The current supply chain and infrastructure of our hydrocarbon energy system can largely be re-used for Hydrogen. Pipeline, storage facilities, as well as heat generation and industrial practices. In the transition period this means blending of H2 with our natural gas and other chemicals, as well as capturing CO2 until we can fully depend on our renewable sources and geothermal solutions for energy, mobility and heat.

- Governments, and public are united towards carbon neutrality in 2050. All recognize that Hydrogen is therefore essential, and are putting their money down where their mouths tell us the energy system will go. Current investments are globally in tens of Billion euros per year in Hydrogen alone. The estimated gap (on top of current market investments) to be covered is estimated to be >100B€ in the 10 years to come. And this investment is already made available.

The current market of Hydrogen today

The hydrogen market today is >75 MtH2/yr, existing and mature, and will grow by itself with 20% over the next 10 years. This growth will be achieved without additional energy transition change focus. Add that additional demand and the growth will multiply the original 20%, to hundreds of percentages. These projections are supported by many Industry expert reports1,2,3,6 and communications4,5. All come to the same conclusion: Hydrogen is needed for our transition towards a full sustainable energy system, and therefore will play a significant role within.

Hydrogen will play a significant and important role within the Energy Transition.

Although the Hydrogen market is mature (2018 = 135B$/y, 2020 = 177B$/y), the tiny molecule today is predominantly produced from hydrocarbon resources (gas/coal) and therefore polluting (grey Hydrogen supply). Demand is limited to industrial applications for the production of fertilizer, as chemical catalyst in refining, or as feedstock for steel production.

Very little Hydrogen comes from VRE (Variable Renewable Energy) and it plays no role yet as energy vector (see absence in the BP graph). This is mainly due to our current market economics and dependency on hydrocarbons, which make conversion to green hydrogen inefficient, uneconomical and illogical. Nevertheless, the mature value-chain brings the advantage that processing, handling, procedures, as well as regulations are in place. We know how to safely produce, and transport it, and we can store Hydrogen for any duration.

In summary, we know how to ‘manage’ Hydrogen, it has a similar value-chain to hydrocarbons, but with a great advantage that it leaves no environmental footprint behind when used. You use Hydrogen as energy-vector through a fuelcell and you get water as output. This is a solid base for the future public acceptance of Hydrogen as ‘the’ energy molecule to support the energy transition. Nevertheless a solid base does not mean general acceptance and trust is a fact. Public perception will remain a major challenge that cannot be underestimated. Clear and transparent support by science and governments shall continuously positively influence the perception H2.

What is needed to boost the Hydrogen uptake into action?

Referring also to the conclusions of the EES2020 Call to Action, the collaborative conclusion was rather simple. What is needed, is a lot of focus and investment on Hydrogen research, innovation and technology, as the curves of improvement need to be steep. Where this focus must start is in industrial ports and clustered Hydrogen valleys for reasons described below. And how to stimulate excitement and common interest from universities, corporates, and the general public, this is by being uniform, clear and transparent on our governmental direction for Hydrogen and adjust our fiscal and financial support structures to reflect the same.

Stimulate global trade for acceleration of growth

So back to the Call to Action, and the current Hydrogen market where supply and demand is existing. Today’s demand is purely for industrial use and needs a boost to accelerate growth. Sustainable demand in mobility and global trade can accelerate this necessary increase in demand. On the other hand, supply must keep up, and achieve zero environmental impact at the same time. This means current production must evolve from grey, to blue and swiftly to green Hydrogen. This is a complex transformation and the diagram (Rystad, 2020) gives a simplified idea. Public incentives and taxation schemes should be clear and stable with a solid direction towards carbon neutrality. And roadmaps to support this, must be transparent and inspiring. Although the plan will show, disheartingly, a required progress and continuous initiation of projects the size that we have not yet achieved, still we have no option. We will have to start walking in the right direction and be clear and energized about it.

Where to geographically start?

So where to start? Or better still where did we already start building the foundation for this energy system transformation? A geographical region where complete value-chain development, from production, distribution, storage and new demand is clustered and stimulated is called a Hydrogen Valley. Obvious hotspots for these are ports and major harbors. These industrial and trade ecosystems have closely located supply-and-demand. They also service marine mobility as well as land mobility. Heavy industry is present, which acts as the current demand of Hydrogen, and major ports are often landing locations for offshore renewable energy as well as our existing gas-infrastructure (this is important for immediate and future storage of CO2 or transportation of offshore H2). The majority of the 25 existing Hydrogen Valleys today, are situated in harbor coastal areas. And thus, proving that today’s investors are in agreement with focus and benefits on major ports.

Why basic cost-economical arguments must be disregarded for investment in our future.

Still, we need an acceleration and adaption of a highly complex energy system. There is no denying we need to change to save our planet. Total cost of ownership (TCO) must be a principle closely applied for our future investments. This means that our current economic cost arguments (i.e. the argument that Hydrogen, and Renewable energy is too expensive) are not logical as waste and environmental impact to our planet are not considered.

Many talents and experts are working towards a better world. Technology, inventions and solutions are published monthly, each with their own holy grail. But there is not one silver bullet, there are many. Hydrogen is in the energy field certainly not a stand-alone solution. It is an energy vector that should be developed alongside full electrical solutions, and with CarbonCapture and Storage (CCUS) options. No matter what the current cost-economics indicate. The parallel development of Hydrogen as part of the energy-system, is an investment for the future, and will act as enabler in the collaboration of renewable and transition energy sources towards carbon neutrality. Hydrogen (in comparison to batteries) can also result in hundreds of Billions of euros savings by re-use of infrastructure and acceleration of intermediate solutions6.

If we accept that Hydrogen will play a significant role in the energy market, then we should make the economics works also, but this needs time. This means focus on innovation to improve and accelerate efficiency in production, distribution, storage and future fuelcells. In other words, we will need a boost of investment that stimulates collaboration through open innovation, competition and the creativity of the masses, i.e. the SME innovative power. Those innovators, start-ups, scale-ups and existing SME-market just need a nudge in the right direction by first mover stimulus and a clear long-term story that underwrites trust in the future of this tiny molecule.

Innovation, the needed centrifugal forces to spurn out the future

Firm belief in Hydrogen is becoming clear. The roadmap for Hydrogen in the EnergyTransition is pencilled in. Investments, subsidies and tax-schemes are available. Projects are starting daily, not only by large corporates and scientific universities, but by profitable medium sized companies with solid technology and already a strong competitive business model. With visibility in the potential sustainable future market the Innovation graphs will curve upwards. Focus and innovation output will start to show logarithmic improvements of efficiency of H2 electrolysis and production. With today’s investment, the curve is expected to follow a similar trend as the digital revolution, or what Solar-and wind-energy markets have shown in the last 20 years. Cost improvement will follow downward trends with maturation, scale, increase in international trade, and optimization of infrastructure and demand. Moore’s law for transistors’ capacity doubling every 18months, linked to Rock’s law where costs are cut in half will have similar implications for energy system and Hydrogen.

In summary: stop denying the role of Hydrogen, collaborate, innovate and conquer.

Let’s summarize this article in a simplified roadmap. Renewable energy with affordable TCO (total costs of ownership for this planet) is desperately needed. And we all agree and have set goals for carbon neutrality in 2050.

The current economics and complexity of our global value chain of energy, makes this an intrinsically challenging transformation. Many innovative solutions and approaches are needed, and there is no one-stop-miracle. Hydrogen will play a significant role: the energy-vector leaves no footprint after use, is relatively easy to store, can be distributed through existing infrastructure, and a global market already exists. Transition is supported and can be accelerated through the fact that the value-chain has strong similarities with our current Hydrocarbon distribution and ICEs (Internal Combustion Engines). Parallel roadmaps can, and must be accepted, resulting in a required escalation of innovative focus and collaboration.

In 2030 we will, in hindsight, be impressed with the speed and what was possible from a complete system change perspective. Certainly, when we collaboratively set our minds to it.

At least that is my expectation when I see the first results of collaboration projects, research initiatives, subsidies and commercial activity towards making our energy system sustainable and carbon neutral. Specifically, the European Union’s catalystic focus and determination for Hydrogen puts a serious peg in the sand and is inspiring. The rest of the world is following, but not far behind.

The next articles will zoom in on specific parts of the hydrogen value-chain and highlight future use-cases. We will look at production, distribution, storage and demand more closely, and hope to inspire you at the same time.

Sources:

1 IEA G20 report June-2020: The future of Hydrogen,

2 Rystad report of December 2020, Energy societies in 2050,

3 McKinsey&Companies (with a source of own survey and interviews of hydrogen council members),

4 Various forums: (www.fchju.eu), www.h2v.eu

5 Conferences: including the last MIT ILP Webinar on low carbon fuels,

6 BakerMackenzie: Hydrogen report, 2020

8 BP Energy outlook 2020